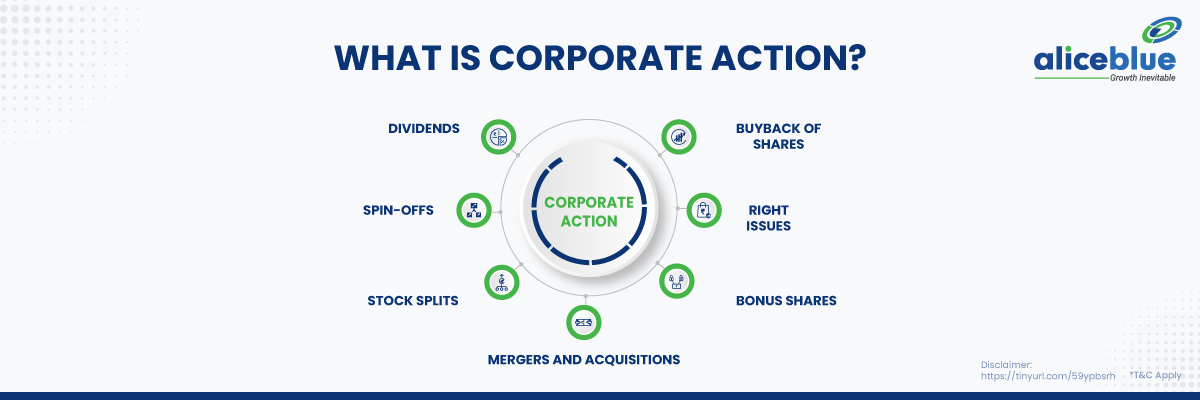

What Are Corporate Actions?

In language, corporate actions mean an action taken by a company or a corporate entity that lays a direct impact on a company’s share price. The Board of directors of the company initiates these actions which are approved by its shareholders. The majority of retail simply buys stocks on the announcement of a corporate action, which is wrong. Let’s dig deep into the realm of corporate actions as you would learn in a stock market institute in Noida

Types of Corporate Action

- Bonus Issue

Let’s

understand bonuses through an example:

If

someone had bought 1,000 shares of Infosys in 2003, and not invested

thereafter, his current shareholding is 16,000 shares of Infosys. Surprised?

The number of shares increased because of the bonus shares issued by the

company in the past 20 years. A bonus issue is a share given as a reward

to existing shareholders to distribute gathered reserves instead of giving

dividends. This also makes the share price affordable for small investors.

There is no change in the face value of the share.

- Stock Split

One of

the most intriguing ways of reward distribution from companies is- splits. Yes,

you heard it right!

A stock

split doesn’t mean that the stock will get divided, rather the number of held

shares gets split! It is like a bonus where the number of shares increases, but

the investment amount remains the same. In the split, the company reduces the

face value of the stock in the same announced ratio.

- Right Issues

When a

company needs additional capital for its operations, sometimes it approaches

its existing shareholders for extra funds via the rights issue. The

shareholders have a choice and not an obligation to subscribe to the right

issue. The company allots the shares in a proportion of their shareholding.

Let’s take an example; If the company announces a 1:2 Rights Issue,

it means for every 2 held shares, the shareholders can apply for 1 additional

share.

- Dividends

To be put

in simple words, dividends are compensation to shareholders for their trust and

investment in the company. The companies pay dividends from the surplus profits

they earn from their business on a per-share basis.

- Buybacks

When

promoters of a company want to invest in their own company, they issue a

buyback. This directly affects by reducing the liquidity of shares. This is

because, with buyback, the number of outstanding shares available to trade in

the markets gets reduced. Sometimes companies issue buyback at a premium to the

markets, which is perceived as a very lucrative short-term profiting trade for

both traders and investors.

Comments

Post a Comment